In a respectful ceremony, PIPSC formally acknowledged the traditional unceded Algonquin Anishinaabe territory that our national office sits on.

For centuries, Indigenous peoples have been the stewards of the lands that Ottawa now sits on.

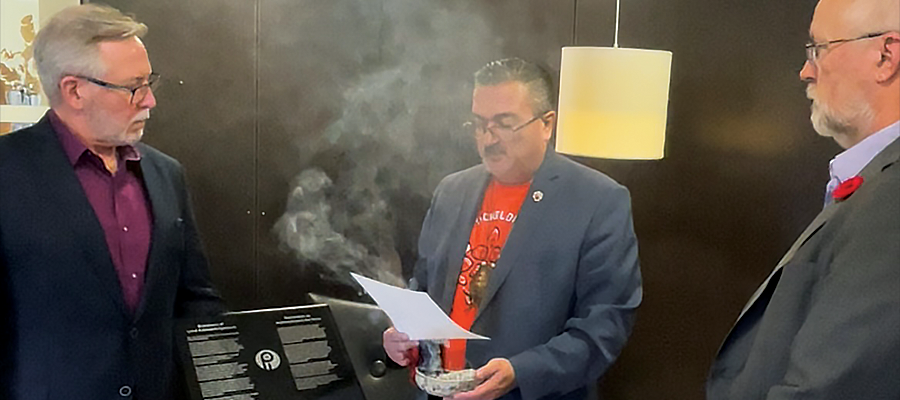

On November 5, 2021, PIPSC Indigenous Representative to the Canadian Labour Congress, Greg “Wolf Star” Scriver, led a smudging ceremony at the PIPSC national office. Smudging is the burning of 4 sacred medicines in an open shell: cedar, sage, sweetgrass and tobacco.

Once the air was cleared, PIPSC Vice-President Steve Hindle placed a plaque in our main lobby. This plaque enshrines our honour and thanks towards the Algonquin Anishinaabe Nation.

PIPSC members are committed to reconciliation with First Nations, Inuit and Métis peoples. This is demonstrated by our partnership with Indigenous Day Live, the work of our Indigenous Caucus, and now our territorial acknowledgement in our office.

We recognize the important role of the labour movement in reconciliation. We must listen to the demands of Indigenous leaders. We can support Indigenous-owned businesses. And we can support Indigenous culture and languages through education and art.

To take action for reconciliation, contact the Human Rights and Diversity committee.

You can also write to the Prime Minister of Canada to join the Canadian Labour Congress’ call for real commitments and concrete justice for Indigenous peoples and communities.

Leading Progress: The Professional Institute of the Public Service of Canada 1920–2020 by Dr. Jason Russell, Canadian labour historian, is now available to all members in an e-book (epub) format.

Leading Progress: The Professional Institute of the Public Service of Canada 1920–2020 by Dr. Jason Russell, Canadian labour historian, is now available to all members in an e-book (epub) format.

Stephen Bent (AFS)

Stephen Bent (AFS) Ginette Tardif (SH)

Ginette Tardif (SH) Award

Award Dr. Ming Hou (RE)

Dr. Ming Hou (RE) Eva Henshaw (CS)

Eva Henshaw (CS) Claude Lord (NFB)

Claude Lord (NFB) Rob Macdonald (SP)

Rob Macdonald (SP) Colin Muise (SH)

Colin Muise (SH) Central Bargaining Team:

Central Bargaining Team: