Historic swearing in of the Right Honourable Mary Simon as Governor General

Date – Friday and Saturday, November 5 and 6, 2021 – virtually

Online registration

Open August 2 to October 15, 2021.

Once notified about being selected to attend the AGM, all delegates and observers have to complete the online registration form. Please note that the deadline for registration will be strictly enforced.

Delegate selection process

Group Presidents and Regional Directors must submit their list of approved delegates and observers to Allison McAleer at amcaleer@pipsc.ca, taking into consideration the October 15 registration deadline.

Once the lists are received, the National Office will email each delegate or observer to invite them to register online. The delegates and observers won’t be able to register until an approved list has been received from groups and regions.

The number of delegates for the AGM is defined in By-Law 13 and in accordance with the delegate count.

Changes to Institute by-laws

By-Law 13.1.4.1 states "No By-Law shall be enacted, repealed or amended by a General Meeting unless details of proposed changes were submitted to the Office of the Executive Secretary no later than twelve (12) weeks prior to a General Meeting." Proposed amendments to the Institute By-Laws must be submitted by August 13, 2021, by email to amcaleer@pipsc.ca.

Resolutions

By-Law 13.1.4.3 states "Resolutions, in writing, must be received at the Office of the Executive Secretary not less than twelve (12) weeks before the commencement of a General Meeting."

Resolutions must be submitted by August 13, 2021, by email to amcaleer@pipsc.ca.

AGM resolutions are first received by the Resolutions Sub-Committee (RSC), comprised of the following members:

- Nancy McCune (Chair / BLPC Chair)

- Chris Roach (AC Director / Finance Committee Chair)

- John Purdie (BLPC)

- Tony Goddard (BLPC)

- Dan Jones (Finance Committee)

- Benoit Pelletier (Finance Committee)

- Craig Bradley (AC)

- Eddie Gillis (COO & Executive Secretary, Staff Resource)

- Julie Gagnon (EA to COO, Staff Resource)

The mandate of the RSC is to consolidate, monitor, and clarify resolutions for submission to the AGM. The RSC is available to help and to provide advice to sponsors regarding wording to ensure clarity and compliance with Institute By-Laws and Policies. If there is a cost associated with resolutions (financial resolutions), sponsors should submit related numbers with their resolution, for review by the RSC.

To assist in the process of writing resolutions, please refer to the pocket guide “Write that Resolution”, or contact a member of the RSC.

Please note that only resolutions sponsored by the Board of Directors, by groups, by regions and by the Retired Members’ Guild, will be accepted for presentation at the 2021 AGM.

Institute fees

Pursuant to By-Law 14.2.1, which governs fees, notice is hereby given that a change in the basic monthly fee may be proposed at the 2021 Annual General Meeting.

It is with a profound sense of sadness that the Institute informs you of the passing on July 7, 2021, of our friend and colleague, Charlotte Rogers Mehkeri.

Charlotte was part of the first executive of the Ottawa Centreville Branch. She was active in the AFS Headquarters Subgroup and was a long-serving steward.

The Institute extends its condolences to Charlotte’s family and to the many friends who were privileged to know her.

Condolences can be expressed online.

It is with a profound sense of sorrow and regret that the Institute informs you of the untimely passing of our friend and colleague, Mr. Glenn Maxwell. Glenn passed away on July 10, 2021. His commitment to Institute members was deep and unwavering. He will be missed. We will remember him with respect and gratitude.

It is with a profound sense of sorrow and regret that the Institute informs you of the untimely passing of our friend and colleague, Mr. Glenn Maxwell. Glenn passed away on July 10, 2021. His commitment to Institute members was deep and unwavering. He will be missed. We will remember him with respect and gratitude.

Glenn was a CS Group member at DND’s 8 Wing at Canadian Forces Base Trenton, the hub of the Royal Canadian Air Force air mobility operations in Canada (responsible for search and rescue operations in Canada, delivering supplies to the high Arctic, and airlifting troops, equipment and humanitarian loads worldwide).

Glenn served Institute members with distinction in a number of capacities over two decades, notably as a steward, chair of local, regional and national consultation teams, as President of the CS Quinte Sub-Group, Vice-President of the Quinte Branch, Advisory Council Director, and member of the Board of Directors (2015-2018).

The Institute presented Glenn with the Steward of the Year Award and several Citation Certificates in recognition of his outstanding commitment to members and the Institute.

His spirit, intelligence, and commitment will be greatly missed by colleagues and PIPSC members who had the good fortune to work with him.

The Institute extends its condolences to Glenn’s family and to the many friends who were privileged to know him.

Condolences and memories can be expressed online.

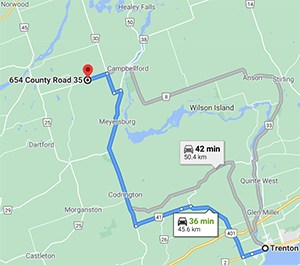

You are invited to an Open House (outdoors) to share your memories of Glenn.

August 14, 2021 – 11 a.m. to 4 p.m.

654 County Road 35, Campbellford, ON

R.S.V.P.: Jeanne Ann Maxwell jeannemaxwell@yahoo.ca

Please bring lawn chairs and umbrellas (in case of rain).

For more information: https://www.facebook.com/glenn.maxwell.18

Samah Henein came to Canada 30 years ago from Egypt with a BA in Commerce to have a better life. She wanted the job security that the public service offered, but also wanted to work somewhere she could learn, grow and have balance in her life. Samah applied as an auditor with the Canada Revenue Agency (CRA) in 2005.

“The union makes the workplace a better place. There is more satisfaction with the employee, work conflicts get resolved faster, the union provides tools and resources to workers so they know their rights. The union fights for employees to get a good collective agreement and empowers them to do better,” Samah says.

Growing up, Samah witnessed her mother face dozens of challenges in her factory workplace. Her mom had to fight for equitable promotions and better working conditions. Watching her mother fight for equality and fairness throughout her life inspired Samah to speak up for herself and her coworkers at the CRA. This was one of the main reasons she decided to become a PIPSC steward.

“It’s important to empower people who are not able to voice their concerns and issues and to give them the resources they need to succeed,” she says.

Since starting her union work with PIPSC, Samah has made lasting changes in her workplace. She helped a member suffering violence at home to seek support and look after their well-being by taking time off from work. She won a grievance that earned a member a promotion, and helped another colleague change a leave type from unpaid to paid because of health reasons.

Most of all, Samah says she is proud that her coworkers can have a healthy work-life balance knowing that they are never alone when their job becomes challenging.

“We need to listen to members and ensure they are heard, for example if they have requests for accommodations,” she says.

At the CRA, Samah works in the Scientific Research Experimental Development division. In her role as a Financial Reviewer, she works with Canadian businesses who perform their research and development in Canada.

This work helps stimulate the economy and increase financial support for people in Canada. Her work in the public service doesn’t end with her contributions to her local union, she helps empower Canadian workers and businesses every day.

“I work with brilliant scientists and strong teams,” she says. “We are there to support businesses and they know we are accurate, timely and fair supporting their rights as well.” Samah is proud of the work she does to support Canadian businesses and her union work supporting her colleagues’ rights. She’s has been involved in the union for five years and is now the vice-chair of the Prairies/Northwest Territories Region and an important member of the PIPSC Human Rights and Diversity Committee. She makes sure members’ voices are heard.

“We are here to protect people’s rights. This year, the union negotiated our contract in an efficient way and fought against outsourcing while also fighting to support people going through grievances,” she said. “PIPSC makes sure that our workplace is safe and healthy.”

A union is its members, and it’s people like Samah that make a union strong. Despite our important accomplishments this year, Samah said she believes there is more work to be done together as a union to make changes across the country and within our union.

“A better Canada is where everyone matters equally,” she says. “PIPSC can be the vehicle for fairness and equality that we need to see everywhere.”

Volunteer to support PIPSC negotiations for the Travel Directive

It is with great sadness that the Institute has learned of the untimely passing of our friend and colleague André Lortie.

As a long-time and highly-respected Institute Negotiator, André worked tirelessly over the years to defend the interests of tens of thousands of PIPSC members, notably with the CS, NUREG and University of Ottawa Groups. He was held in high esteem by both his colleagues and his Employer counterparts.

The Institute would like to extend its sincere condolences to André’s family and to his many friends. It was a pleasure and a privilege to know him. His commitment to PIPSC members was unwavering and he will be truly missed.

PIPSC members and staff who wish to pay their final respects to André are invited to do so on his memorial page.

Congratulations to our winners of our first National Public Service Week contest! Every day, PIPSC members go to work to protect and serve Canadians in a hundred different ways – and our 5 winners are no different.

Cory Graham (Manitoba Association of Government Engineers, Warren, MB) works to create change and improve environmental conditions at former mine sites. Cory is proud to be a PIPSC member because the union promotes fairness for all. Cory has served as a PIPSC steward since 2014.

Chung Yip (Sunnybrook Radiation Therapists, North York, ON) works as a radiation therapist at Sunnybrook Health Sciences Centre. Through Chung’s connection to the union, he understands the labour rules in his workplace and has been able to maintain full-time employment through the pandemic.

Josée Varner (Health Services, Calgary, AB) works as a nurse for Veterans Affairs, and is proud of her work supporting clients while working from home during the pandemic. Josée is proud to be a PIPSC member because she feels supported and heard by the union.

Laila Jiwani (Audit, Financial and Scientific, Scarborough, ON) was inspired by the smiling, positive seniors she helped connect to virtual support during the pandemic. Laila knows that her work and the union will continue to make a difference in shaping a stronger Canada.

Sangeeta Gharge (Computer Systems, Kanata, ON) received an award for going “above and beyond” at work this year. Sangeeta is proud to be a PIPSC member because she knows the union has her back.

PIPSC extends heartfelt thanks to these 5 incredible people and all PIPSC members for their amazing work this year. You’ve been there for Canadians – and for each other. And it’s that extraordinary spirit that will continue to inspire us each and every day.

PIPSC is your ally for building a welcoming and inclusive workplace for LGBTQ2S+ workers

Our LGBTQ2S+ community has overcome incredible obstacles. While we can be happy that we legalized same-sex marriage in 2005, and that we’re making it easier to express gender identity on official documents, there’s still a lot of hatred and discrimination throughout Canada that we must eliminate. LGBTQ2S+ individuals still fear violence following a gruesome homophobic attack in Toronto, Pride flags being burned, and daily microaggressions.

![]()

Canada has failed the LGBTQ2S+ community many times

When queer bars and bathhouses, regarded as LGBTQ2S+ safe spaces, were raided in Montreal, Toronto and Vancouver by local police, LGBTQ2S+ Canadians knew their rights were under attack. How can the community feel safe when being queer is criminalized by the people tasked with protecting us?

LGBTQ2S+ Canadians working in the public service are still healing from the public service purges that went on from the 1950s to the 1990s. A special department was created in the federal government to root out homosexuals from the public service, forcing LGBTQ2S+ workers to live in fear. The government finally apologized for this purge, which still haunts past and present public servants and community members.

And today, men who have sex with men are still barred from donating blood. Although all blood is rigorously tested for any diseases after it’s collected, blood collection policies are still rooted in the 1980s. A straight man can have sex with as many partners as they want, and still donate blood without question. This is nothing short of discrimination.

![]()

The Canadian labour movement has a key role in supporting LGBTQ2S+ communities

The Canadian labour movement is supporting a massive reinvestment LGBTQ2+ communities. LGBTQ2S+ community initiatives are hugely important in building a network of solidarity for individuals who come out of the closet, who need access to services, and who want to build a culture of resistance against homophobia, transphobia and biphobia.

We’ve also called to eliminate Canada’s discriminatory blood donation policies that force gay men to be abstinent before donating blood while heterosexual men can have as many sexual partners as they like.

![]()

Normalizing diversity of gender identity and sexual orientation in the world of work

It’s hard for LGBTQ2S+ Canadians to be comfortable in a heteronormative workplace. Questioning individuals fear their attire under a new gender identity will be considered unprofessional. LGBTQ2S+ people want their colleagues to see them as more than just sexual orientation or gender identity.

We’re proud to support normalizing diversity of sexual orientation and gender identity at work, marking an important departure from heteronormative culture. The “Free to be me” campaign at the Government of Canada is a great initiative, just like Instagram displaying personal pronouns next to user names.

How can I take action?

- Use our Pride Zoom background for your video calls

- Add your pronouns to your screen name in your email signature and social media profiles

- Add your personal pronouns to your work email signature

- Donate to a local LGBTQ2S+ organization in your community

Significant progress has been made, yet the struggle continues. Within our union, the public service and across the country, we have work to do to fight stigma, stop harassment and build the welcoming and inclusive environments everyone deserves.

Trivia contest winners

Congratulations to Larisa and Michael for winning our Pride Trivia contest!

After leaving a series of hints and clues on our Facebook page, PIPSC members joined a virtual trivia contest on July 27 and 28, 2021. Canadian Labour Congress Vice-President Larry Rousseau was our featured guest host.

Shop from Canadian LGBTQ2S+ merchants

Contest winners took home $250 Etsy gift cards, and are encouraged to support Canadian LGBTQ2S+ merchants in the Etsy virtual marketplace.

- GRRRL Spells (Toronto, ON) – A queer non-binary & POC owned shop that specializes in queer art and accessories

- little rainbow paper co (Calgary, AB) – Hand-drawn original digital and watercolour art produced on LGBT cards and prints

- Yas Petit Poulet (Montreal, QC) – LGBT+ owned small business with the slogan “where pride meets art meets science,” with products focused on exploring queer identities through the lens of science

- L’Amour Propre (Toronto, ON) – Queer and sex-positive accessories, including key tags, pins, pet tags and other custom and engraved products

- NeebingAndMary (Canada) – Queer flags, pop culture, and protest swag

- YasakwDesigns (Haida Gwaii) – LGBTQ2S+ Indigenous owned clothing and accessories

- Lovestruckprints (Montreal, QC) – Clothing, accessories, illustration and cute stuff screen printed in Montreal

- WerksByAshley (Windsor, ON) – Pop culture-inspired illustrations and products

- ShatteringTheCeiling (Montreal, QC) – Shattering the norms by making fun, sassy and inclusive art

- HandandThistleShop (Toronto, ON) – Beautiful boho-chic crafts to make your space cozy

Public Service Pride

Members of the federal public service are encouraged to join Public Service Pride, happening from August 23 to August 27, 2021. Learn more.